Originally published by Anna Ottosson (in Green Queen)

The alternative protein market is on fire right now, estimated to be worth approximately $2.2Bn, and cultivated meat is expected to play an important role in the shift from traditional meat products. Experienced scientists are engaging in so called cellular agriculture with the aim of reducing animal-based agriculture’s negative impact on both the planet and the suffering of animals and at the same time feeding a growing population.

It may take a while for consumers to accept the idea of growing meat in a lab rather than on a farm, but with increasing concerns over food safety and security there is an ongoing shift in perception and priorities which is feeding the growth in cultivated meat development.

However, not everyone is as positive about the meat of the future. Animal rights activists such as Clean Meat Hoax play a part in the resistance, but those with the biggest stake (steak?) are livestock farmers, with collectives such as the European Livestock Voice determined to give consumers another perspective on the industry.

Here at Trellis Road, we’re of course following the startups and the development in this area closely. In this post we have summarized the startups across different subsectors to provide a snapshot of the state of the space.

A couple of things to note before diving in:

- We’ve primarily based our breakdown on GFI’s incredible data. We may have missed a few startups, so feel free to get in touch and let us know; the field is evolving so rapidly that it’s been tough to keep track.

- We’ve grouped startups by their main product focus according to GFI, but we have no doubt that many of them may be experimenting with multiple products and technologies.

- As always, the downside with overviews like these is that it’s high level and hence ignoring some of the complexities of the industry, but we hope you appreciate the picture of how the space has evolved over time.

- We’ve excluded cultivated seafood as we have that covered in a previous post (and a previous newsletter). Also, as our focus this time is on meat, we’ve excluded cell-based dairy products.

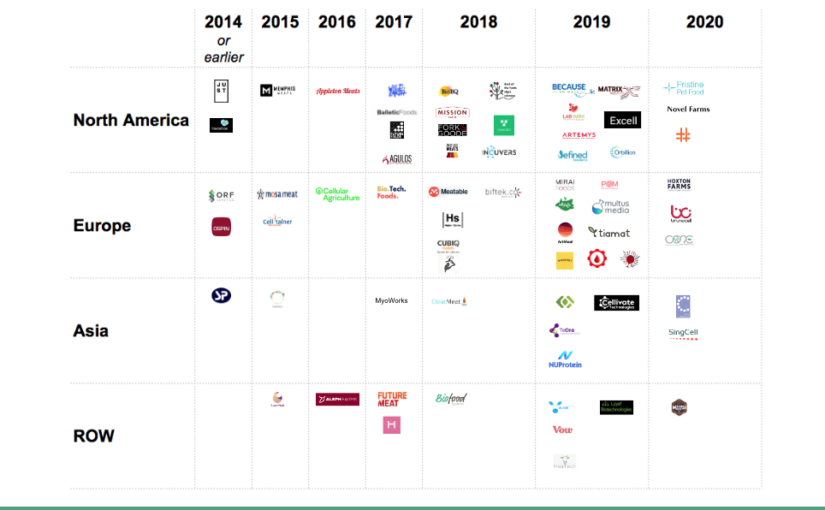

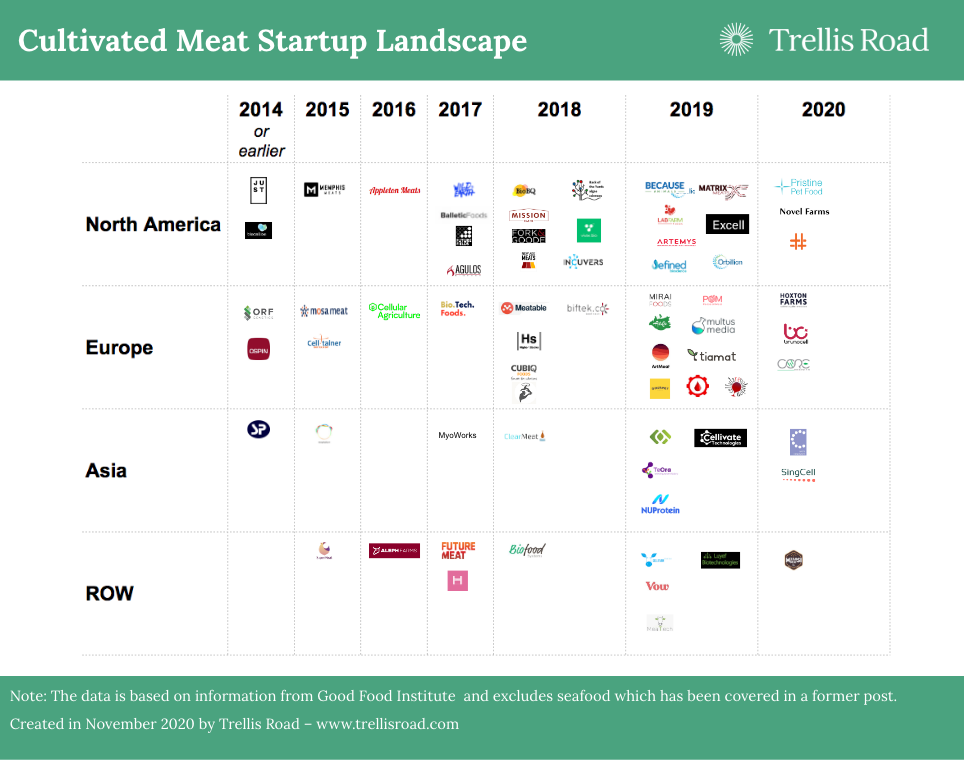

In the graphic below we’ve looked at the cultivated meat landscape based on two key groups of startups; the ones primarily focusing on producing the actual meat and the ones focused on enabling technologies.

Looking at the companies focused on producing the actual meat it is evident that beef has for long been the most attractive meat type to focus on, with 14 companies in the category compared to only two focused on chicken and four focused on pork, probably because industrial beef production is the worst for the environment, so eliminating it with cultivated alternatives would make the biggest impact. In addition, the higher price point for beef makes price parity for a cultivated product at some point in the future more likely than it might be for cheaper meat types such as pork and chicken.

In the group of startups focusing on enabling technologies the biggest subcategory is Cell Culture Media, where 2019 showed a real increase with a whole of eight new startups. This might be seen as the industry now being developed enough to show growing demand for cell culture media, and we’ve also heard multiple founders state that they started working on cultivated meat products only to realise the cost and challenges related to the media, including making it truly animal-free. Another category that judging by this data has gained more interest in the later years is Scaffolding and Structure where four new startups has emerged since 2019.

Looking at it from a geographical standpoint we can see that North America and Europe dominates the industry; there are 25 companies based in North America, 23 in Europe and only ten in Asia as well as an additional ten from other parts of the world. Two countries that stands out as being a little extra relevant are Israel and the Netherlands; Israel having five startups in the sector despite only having 9 million inhabitants and the Netherlands having four startups in the sector despite only having 17 million inhabitants.

The Animal-Free Cultivated Meat Startup Landscape

Here’s the full list in alphabetical order:

Aleph Farms (Israel, 2016, beef) — this crew are planning on cultivating their steaks in space; their ideas are literally out of this world (famous for getting the first ever head of a government to try cultivated meat)

Alife Foods (Germany, 2019, beef) — consumer-first and product-orientated, working on cultivated meat processing, refinement and branding

Ants Innovate (Singapore, 2020, mixed/unspecified) — focused on integrating muscle tissues, and developing healthier formulations for premium cultured meat products

Appleton Meats (Canada, 2016, beef) — currently working on scaling up the production of clean ground beef, to serve the Canadian cellular agricultural market before expanding into the US

Artemys Foods (US, 2019, mixed/unspecified) — working in the pursuit of guilt-free meat and a world without intensive animal agriculture

ArtMeat (Russia, 2019, other meats) — cultivating horse and sturgeon cells, with a plan to bring products to market in 2023

Balletic Foods (US, 2017, mixed/unspecified) — currently operating in stealth mode, working on bringing cultured meat to the masses

Because Animals (US, 2019, pet food) — creators of the world’s first cultured meat pet food, a cat treat made from cultured mouse, and now working on a cultured rabbit dog treat

BioTech Foods (Spain, 2017, mixed/unspecified) — its brand, Ethicameat, covers a range of cultured meat products which are high in protein, fat-free and antibiotic-free

BioBQ (US, 2018, beef) — located in the land of true barbecue, this brand aims to be the first to offer cultivated beef jerky and beef brisket

BioFood Systems (Israel, 2018, beef) — currently in stealth mode, this company has a patented process to cultivate bovine stem cells using an animal-free cell culture media

Brunocell (Italy, 2017, mixed/unspecified) — finances and manages cell-based research projects

Cell Farm Food Tech (Argentina, 2019, beef) — Latin America’s first cultured meat startup, it has a proprietary stem cell bank with the best Argentine bovine genetics

Cellular Agriculture Ltd (UK, 2016, mixed/unspecified) — this company’s tech sits at a footprint 200x smaller than incumbent bioprocess and at a 70% reduction in operational cost

Clear Meat (India, 2018, mixed/unspecified) — India’s first eco-friendly, nutritious and affordable meat initiative (they claim to have reached price parity with conventional chicken during trials)

Cubiq Foods (Spain, 2018, fats) — develops and produces cultivated fats from animal cells, with a whole host of health benefits

Fork & Goode (US, 2018, pork) — a spinoff startup from cellular agricultural biomaterial company Modern Meadow, focused on cultivated pork products

Future Meat Technologies (Israel, 2017, chicken) — these guys have already achieved a chicken kebab prototype

Gaia Foods (Singapore, 2019, beef) — vertically-integrated cultured red meat producers

Gourmey (France, 2019, other meats) — oh so French, this brand’s first project was a cultured foie gras produced from natural duck cells, no force-feeding allowed

Heuros (Australia, 2017, mixed/unspecified) — this company’s products are made without genetic engineering, so products can be sold as GM free

HigherSteaks (UK, 2018, pork) — focused on pork products, and launched the world’s first lab-grown bacon and lab-grown pork belly in July this year

Hoxton Farms (UK, 2020, fats) — just scooped the food & drink category award at The Royal Society of Chemistry’s Emerging Technologies Competition 2020 for its work in speciality fats

Innocent Meat (Germany, , 2018, mixed/unspecified) — all about efficiency (unsurprising), with fast growth cycles, media volume reduction and waste elimination

Integriculture (Japan, 2015, beef) — part of the Shojinmeat Project, a non-profit which was founded to engage and inform people about cultured meat and allow them to grow it at home!

JUST (aka Eat Just & now GOOD Meat) (US, 2011, beef) — best known for its work in plant-based eggs, but also working on cell-based Wagyu beef as a side hustle and now world-famous for being the first cultured-meat to get government regulatory approval (for its cultured chicken bites) and claims the title of first commercial sale of cultured meat

Lab Farm Foods (US, 2019, mixed/unspecified) — just announced as part of Merck KGaA’s 2020 Accelerator Cohort, alongside membership in NYU Langone’s Biolabs Incubator

Meatable (Netherlands, 2018, beef) — can make the same amount of meat in three weeks as would take a cow three years to grow

Memphis Meats (US, 2015, mixed/unspecified) — one of the originals, these guys raised a mind-blowing $161M at the start of 2020 to continue developing their chicken, beef and duck prototypes

Mirai Foods (Switzerland, 2019, beef) — initially working on minced beef and covers the entire value chain, from R&D to distribution

Mission Barns (US, 2018, pork) — creators of Mission Pork Bacon and Mission Fat, both of which are kosher

Mosa Meat (Netherlands, 2015, beef) — made the world’s first cell-based beef burger and closed a $55M series B round in September 2020

Mzansi Meat (South Africa, 2020, beef) — Africa’s first cell-based meat startup, with a focus on developing products which are specifically tailored for traditional African dishes such as braai

New Age Meats (US, 2018, pork) — this team developed the first lab-grown sausage, which is ‘smoky, savoury and tastes like breakfast’

Orbillion Bio (US, 2019, beef) — working on heritage meats from premium heirloom breeds, with a farm-to-table story

Peace of Meat (Belgium, 2019, fats) — developers of cultured fat to add taste and texture to plant-based ingredients. Soon to be acquired by MeaTech.

Pristine Pet Food (US, 2020, pet food) — trying to revolutionise the way pet food is made, eliminating by-products and reducing disease rates

SingCell (Singapore, 2020, mixed/unspecified) — stem cell manufacturers offering integrated testing, process development and GMP manufacturing solutions

Supermeat (Israel, 2015, chicken) — working to develop ‘meal-ready’ cultured chicken, debuted world’s first cultured chicken tasting restaurant (non-commercial)

Vow Food (Australia, 2019, other meats) — working on lab-grown kangaroo meat, most Australian thing ever

Wild Earth (US, 2017, pet food) — focused on koji-based protein using their fermentation platform, alongside cultivated mouse meat, both for pet food. Co-founder Ryan Bethencourt is one of the investors behind Sustainable Food Ventures

Cultivated Meat Startups Landscape: Enabling Technologies

Here’s the full list in alphabetical order:

Agulos Biotech (US, 2017, cell culture media) — developing Simulated Platelet Lysate (porcine), a replacement for FBS

Back of the Yards Algae Sciences (US, 2018, cell culture media) — algae is hot right now, and this team is working on algae-based cell culture media

Biftek (Turkey, 2018, cell culture media) — creators of a novel culture medium supplement formulation to grow muscle stem cells, which dramatically reduces production costs when compared to a conventional FBS

Biocellion (US, 2013, software) — developers of cell culture modelling software for virtual experiments, so businesses can test theories and products before starting on laboratory experiments

Boston Meats (US, 2020, scaffolding and structure) — committed to creating the true texture of meat through a sustainable and scalable process

Cellivate Technologies (Singapore, 2019, cell culture media) — a spin-off from the National University of Singapore, and has patented a nanotechnology which enables cells to better adhere and accelerates their growth while maintaining vital cellular markers

Cell-tainer Biotech BV (Netherlands, 2015, bioreactors) — building bioreactors for cell culture and microbial fermentation; currently working with Mosa Meat

CellulaREvolution (UK, 2019, bioreactors) — developers of enabling technologies, including a peptide coating which increases cell proliferation in serum-free conditions, and a bioreactor capable of serum-free continuous production of adherent cells

Core Biogenesis (France, 2020, cell culture media) — next-generation recombinant protein production technologies

Cultured Blood (Netherlands, 2019, cell culture media) — exactly as you’d expect from the company name, these guys are aiming to produce a viable artificial blood circulation system

Defined Bioscience Inc (US, 2019, cell culture media) — developing cell culture reagents, growth medium and kits to grow high quality stem cells and iPSC derived cells and organoids

Excell (US, 2019, scaffolding and structure) — working on mycelium scaffolds for cultured meat, tissue engineering and biomedical applications

Future Fields (Canada, 2017, cell culture media) — this company’s end goal is to enable the commercialisation of the cultured meat industry through providing customised growth media, growth factors and enabling solutions at disruptive costs

Incuvers (Canada, 2018, incubators) — inventors of the world’s first smart incubator, complete with ‘virtual lab assistant’ for live cell imaging and monitoring

Luyef Biotechnologies (Chile, 2019, cell culture media) — B2B R&D to support the cultivated meat industry

Matrix Meats (US, 2019, scaffolding and structure) — we hope they don’t get a glitch in their nanofiber scaffolds, which support cell proliferation

MeaTech (Israel, 2019, 3D printers) — focused on 3D printing, and just invested €1M in Peace of Meat to help develop its technologies

Multus Media (UK, 2019, cell culture media) — creators of an animal-free serum substitute; its growth media will allow customers to produce competitively-priced, high quality meat products

Myoworks (India, 2017, scaffolding and structure) — looking to manufacture and supply scaffolds for the global cultivated meat industry

Novel Farms (US, 2020, scaffolding and structure) — producing cruelty-free, marbled cell-based meat delicacies for ‘ethical foodies’

NUProtein Co Ltd (Japan, 2019, cell culture media) — developers of wheat germ-based cell-free proteins

ORF Genetics (Iceland, 2001, cell culture media) — global leaders in barley biotech, received a €2.5M award from the Grant Management Services of the European Commission earlier this year for R&D of animal-like growth factors

Ospin Modular Bioprocessing (Germany, 2014, bioreactors) — working on bioreactor systems for cultured meat and tissue engineering

SunP Biotech (China and US, 2014, 3D printers) — working on bioprinters and bioink for cultivated meat production

TeOra (Singapore, 2019, cell culture media) — producing cultivated meat growth factors with a microbial optimisation platform

Tiamat Sciences (Belgium, , 2019, cell culture media) — manufacturers of plant-based growth factors and proteins for cellular agriculture

Vivax Bio (US, 2018, 3D printers) — focused on 3D bioprinting solutions for cultivated meat

This post originally appeared on Medium, read it here. It is reprinted here with permission from the author.

Lead image of GOOD MEAT at 1880 Restaurant in Singapore courtesy of Eat Just / GOOD Meat.